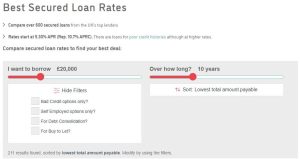

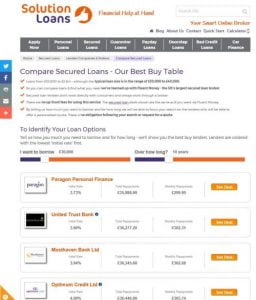

Improved Secured Loans Table – Now Fully Filterable

Our new filters mean our secured loan product & lender table is more usable than ever before. Find your perfect loan from over 600 options....

Read storyHow To Get A Great Secured Loan Deal

Secured loans aren't as well known as remortgages. Yet they are a great alternative. Here's how to get the best secured loan deals....

Read storyUnsecured lending is down but so too are secured loan default rates

The UK economy is cooling off. Its growth is slowing and interest rates have slowly started to rise. Consumers are cautious and so are lenders. Approvals for un...

Read storyCompare all the UK’s Secured Loans & Lenders Instantly!

Use our new secured loan comparison tool to see the best loan deals. Rates currently start at 3.73% APR. Compare loans deals instantly. No-fee service....

Read storySteady as she goes for the UK’s Secured Loans market

Growth in the UK's secured loans market is continuing. And there are no signs of any instability. Why might you want to consider a secured loan?...

Read storyA guide to Secured Loans and how they work

On the back of growing house prices people are using secured homeowner loans to access the value in their property. Here are the pros and cons of doing it....

Read storyTypical APR for homeowner loans reduced to 11.8 per cent

If you are considering a homeowner loan then the good news is that the typical rate is now 11.8% - 2 out of 3 customers receive this rate or lower. To apply for...

Read storyNew consumer guide to Homeowner Loans

Our new guide to homeowner loans helps to demystify them and let's you decide if this type of loan could help you get the credit you need....

Read storyWeekly Wordle – Homeowner Loans

A homeowner loan may suit your borrowing needs if you own your home, have a mortgage and want to borrow a larger sum at a lower interest rate. Our guide explain...

Read storySecured Loan v Unsecured Loan

If you are unsure whether a secured loan or an unsecured loan may suit you best then let us explain about each of them in a bit more detail....

Read storyCategories

- Better Borrowing (215)

- Bad Credit Loans (23)

- Car Finance (28)

- Credit Brokers (11)

- Credit Cards (15)

- Doorstep Loans (13)

- Equity Release (3)

- Guarantor Loans (41)

- Logbook Loans (8)

- Mortgages (10)

- Personal Loans (16)

- Secured Loans (20)

- Short Term Cash Loans (31)

- Credit History & Credit Future (30)

- Ditching Debt (41)

- Household & Family (177)

- Better Budgeting & Saving (46)

- Cars – running costs (12)

- Energy bills (19)

- Food bills (13)

- Holidays (12)

- Mobile Phones & Broadband (11)

- Travel (11)

- Yourself (14)

- Income & Work (60)

- Money & Finance (168)

- News (90)

- Property (52)

- Home Rental (10)

- Home-ownership (43)

- Top Tips (106)

- Video & Infographics (30)