PCP Car Finance

- Rental & Purchase options

- New & used cars

- Dealer & private sales

- All credit ratings

- Rates from 9.9% APR

- Rep. APR 19.9% APR

What is PCP?

With PCP you have total flexibility; you keep your options open. Choose to rent the car and hand it back at the end of the contract or make a final “balloon payment” and buy the car outright. You don’t have to make the purchase decision until right at the end of your contract.

We’ve teamed up with CarFinance 247 to find you great deals on your next PCP contract. They’re the UK’s leading PCP car finance broker and rated extremely highly by customers.

Quotes for PCP

- CarFinance 247 rated 4.6/5

- All credit ratings covered

- You get a dedicated adviser

- Car history check & valuation included

- No Fees!

- Questions about PCP? Read our FAQs

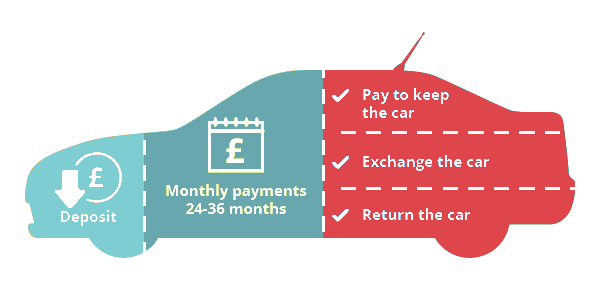

How Personal Contract Purchase (PCP) Works

- You make an up-front payment/initial deposit

- This is followed by fixed monthly payment for the duration of the contract (typically 2 to 4 years)

- At the end of the contract you have 3 options:

- make a final “balloon payment” and keep the car, or

- part exchange the car against a newer vehicle, or

- simply hand the car back

It’s this flexibility that has made PCP deals so popular – estimates suggest that 8 out of 10 new cars are on a PCP contract. There are some practicalities to be aware of:

- There will be mileage limits and if you exceed these you will be charged for the excess miles

- Any damage suffered by the car will need to be dealt with otherwise you will be charged

- You can’t modify the car while you are renting it

- You obviously can’t sell the car unless you have bought it outright at the end of the contract

How to Choose the Right PCP Deal

Our car finance associate CarFinance 247 is one of the UK’s leading car finance brokers. We’ve teamed up with them because they offer excellent service (rating 4.6/5 on Trustpilot) and share our values. Their service extends beyond simply finding your PCP finance. They have an approved network of dealers you can use if you wish, and regardless of where you find your next vehicle, they will check its history and value for your peace of mind. And they do not charge any fee! If you are aged 17 to 21 the Marmalade’s car for young drivers scheme may suit you well.

1: Decide what you need

Consider both the amount you need to borrow and the amount you can afford to repay each month. Learn about car finance

3: Buy with confidence

CarFinance 247 can help you find a car to meet your needs if you haven't already got one in mind. They can provide a history check and valuation for peace of mind. Learn about CarFinance 247Aged 17-21? Learn about Marmalade

4: Get on the road

Once the lender has approved your application CarFinance 247 will pay the dealer for you and all you need to do is collect the car!

Be Aware: Real Life PCP Car Deals

Forewarned is forearmed so the saying goes. The industry isn’t perfect and the FCA is aware of some underhand dealer practices when it comes to PCP car deals. In recent years we’ve written about this in our blog:

OTHER TYPES OF CAR FINANCE

Car finance covers a variety of financial products that enable you to buy a car. In addition to PCP there are other options you may wish to consider. Click on the products you want more information about or compare them side by side.

Which type of car finance product may best suit your needs?

Car Finance Loans Guide

If you’re uncertain which type of credit might suit you or you have a money problem then one of guides may help you. We summarise each type of loan and their pros and cons, and address issues regarding debt and credit ratings.

Got a Question about PCP Car Finance?

Answers to Common Questions

Please note: this information is for guidance only. You should clarify the terms of the loan with the lender before entering into an agreement.

PCP is a form of car lease along with PCH (Personal Contract Hire). The reason they are related is that they are all forms of long term car rental. The only difference is that a PCP deal gives you the additional option to buy the vehicle at the end of the rental contract by making a final lump sum payment often called a “balloon payment”.

So, should you use a car lease/PCH or opt for PCP? The decision will be part financial (i.e. monthly payments) and part flexibility. If you know for certain that you will not want to buy the car at the end of the PCP deal then you might find that going the lease/PCH route is cheaper. But if there is the chance that you’ll want to buy the car at the end then you’ll need to choose PCP.

If you definitely want to own the car at the end of the contract then a hire purchase (HP) agreement may well be the cheaper option overall (though your monthly payments will be higher). However, if there is a chance you will want to hand the car back then a PCP deal will let you delay the ownership decision and in the meantime have lower monthly payments. You achieve ownership by making a final lump sum payment at the end of the contract term.

Personal Contract Purchase (PCP) deals are a flexible way to approach car use/ownership. Whereas hire purchase (HP) commits you to eventual outright purchase and personal contract hire (PCH)/car lease commits you to long term rental without ownership PCP allows you to keep your options open.

This flexibility comes with a cost. Final ownership through a PCP deal could well turn out more expensive than if you’d gone down the HP path. And for long term rental only a PCH/lease deal could also be cheaper.

But this hasn’t stopped PCP deals becoming the most popular form of car finance in the UK.

We’ve explained above how PCP works. PCP is basically long term car rental with the option to buy at the end. Therefore the car remains the property of the finance company while you are renting it. You only own the car at the end if you choose to make the final lump sum payment. Once you own the car you can do as you please with it.

We’d argue that one is not better than the other. The one you should prefer as your car finance solution will depend on your objectives. Hire purchase (HP) is only for those people who definitely want to own the car eventually. While ownership is possible through a PCP deal it is likely to prove more expensive overall. If you are uncertain about ownership then you should not opt for HP.

UK law permits you to cancel certain types of car finance agreement early. PCP agreements are one of these types. Doing this is called voluntary termination and is defined in section 99 of the Consumer Credit Act 1974. This law exists to protect those whose circumstances have changed and are no longer able to afford the monthly repayments.

You can end a PCP agreement early if you have repaid at least 50% of the credit given to you (including interest and fees). You must also take into account the balloon payment and ensure that the car is not damaged beyond normal wear and tear.

It is possible to extend your deal if you feel the car is still giving you what you need and have no desire to buy it outright. You should ask for a quote from your finance company and then compare it against your other options which could include taking out a new deal on a new car.

You probably opted for a PCP deal originally because it offers you flexibility at the end of the contract period. Whereas with HP you have to buy the car and contract hire (PCH) where you have to hand it back, PCP allows you to choose from three options:

- You can keep the car – pay the optional final payment and you now own the car. This final payment could be around a third of the original value of the car

- You can change the car – return the car and exchange it for another on a new deal. If the old car’s value is greater than the optional final payment then you have a surplus that you can use as part of the deposit on the new car (this will also help to reduce your monthly payments).

- You can return the car – as in option 2 when you hand back the car you may have to settle costs for damage and exceeding the pre-agreed mileage. Afterwards, you’ll no longer have to make any monthly payments. If you find that the car is worth more than the optional final payment it would make financial sense to buy it and then sell it privately so as to benefit from that excess value.