Ultimate 101 Point Guide to Improve Your Credit Rating & Maximise Your Loan Acceptance

People forget that there’s no automatic right to getting credit. Creditworthiness has to be earned and then protected.

Your credit file is very much your passport to accessing credit both now and in in the future.

Therefore, it pays to be aware of what you should do to create, manage and improve your credit rating.

And it also makes sense to know what else you can do to maximise your chance of being accepted for loans and credit.

CREDIT PROBLEMS? YOU ARE NOT ALONE

It’s estimated that around 10 million British adults have some form of credit rating impairment or no credit rating at all. The same problem afflicts around 70 million American adults – that’s nearly 30% of the adult population!

Scroll to dive right in – or jump to the section that interests you:

Information in Your Credit File

The UK and USA share the same three major credit reference agencies – Experian (for global sites click link at top right of the page), Equifax and TransUnion (for global sites click link at top right of the page). Each of these holds similar data about your credit behaviour. Those providing you with credit report this data to them. This is your credit file.

Here are some basic things you need to know about your credit file:

1. Know What Your Credit File Does Contain

Your credit file contains your name, date of birth, current and previous address, name of people financially linked to you, a list of your credit accounts (e.g. bank overdrafts (UK), credit cards, loans, utility company debts) your repayment behaviour, public record information (County Court Judgements [called “decrees” in Scotland], house repossessions, bankruptcies, individual voluntary arrangements [IVAs]), whether you are on the electoral register and any fraud information (CIFAS). Public record information, missed/late payments and defaults will remain on your file for six years (UK) and between seven to ten years (USA). Note: UK banks only report current accounts to credit agencies if their terms & conditions permit it. You may or may not find your bank current account listed on your credit file.

2. Know What Your Credit File Does Not Contain

Your credit file doesn’t contain your income (salary, benefits, etc), race/religion/ethnicity, criminal record, medical records, your savings, bank charges, previous rejections for credit, “soft searches”, student loans (post-1998), parking/driving fines, council tax arrears and spouse credit arrears (unless in joint names). Also, it should not include any public records, missed/late payments and defaults information that’s more than six years old (UK) and seven to ten years (USA). Experian has called for new sources of data to be included in credit files to help improve financial inclusion.

“It’s important to remember that whilst your credit score is supposed to define your likelihood of defaulting on a loan, it doesn’t actually include anything about your income. That’s why it’s important to know what your credit score is (and try to improve it) even if you have a high income.”

Jim Wang, WalletHacks.com

3. Understand the Types of Company Adding Data to Your Credit File

Any company providing credit to you will add data to your file. This will include products such as mortgages, credit cards, loans, utilities (electricity, gas and water), mobile phones and insurance (car and home/buildings). But this also means there are numerous companies that can add good news to your credit file.

4. Understand How Credit Reference Agency Data is Used

Credit reference agencies gather and store the mentioned data. They do not make decisions on behalf of credit providers. Credit providers can access the data and, often with the help of companies like FICO, develop their own credit scoring rules for decision-making. Credit reference agencies do provide credit scores to consumers to help guide them, as does myFICO (USA). This consumer business is developing rapidly.

5. Register to Vote – Get Added to the Electoral Roll/Pollbook

Any credit provider will want to be certain about where you live. The most effective way to do this is to register to vote online (UK registration | USA registration) or through your local council (UK) or local county (USA). UK councils publish their registers on 1 December each year and update them monthly. If you move home it’s important to register to vote at your new address. This information is added to your credit file. In October 2019, the UK’s Electoral Commission estimated that around nine million people might be incorrectly registered on the electoral roll. Young people and privately renting tenants make up the largest proportion of this number.

6. Prove Where You Live

If your details on the electoral roll are correct then those on your credit file will be too. However, if you’ve recently moved home you could be refused credit if your credit file is not up to date. You can provide other proof of your new address to the credit provider – a recent council tax bill, utility bill, tenancy agreement, your mortgage details or your driving licence.

7. Can’t Vote in the UK? Add a Proof of Residency

If you’re not eligible to vote in UK local elections then you’re not on the electoral roll. You will need to send the three main credit bureaus evidence of your address as explained in point 6. If you are from the Republic of Ireland, other EU nations and some Commonwealth countries you should be able to be on the electoral roll for local elections.

8. Don’t Change Home or Job Too Often

Lenders like stability. They see it as lowering risk. Being at the same address, in the same job and having the same bank over an extended period is a good sign. Even seeing you have a landline phone number could be beneficial. However, if you rent or are self-employed then just make sure you use as many consistent details as you can.

9. If Your Credit History is from Another Country

As credit files aren’t transferable between countries you’ll need to start afresh in this one. However, make sure you have a copy of your overseas credit report. Offer it to lenders as it could help with your application.

10. Get Good News into Your Credit File

Lenders sensibly tend to place more emphasis on your more recent credit history. If you have adverse news on file from five years ago it will have less value than recent good news. It’s never too late to start cleaning up your file. However, things take time and improvement is gradual.

11. Don’t Ignore Your Council Tax Bill

Council tax arrears are not recorded in your file. It may be tempting to go into arrears to help pay off other debts that you have. However, you shouldn’t. Council Tax is termed a “priority debt”. You need to pay it before debts like credit cards. If you go into arrears your Council will quickly take you to court. You could also end up paying court costs and bailiffs fees.

12. Paid Debts Stay on File – That’s Good!

You may think that paying off a debt gets it off your file and this helps improve your credit score. While the debt is removed your repayment behaviour is not – and that’s a good thing. If you’ve stayed in control of your payments then you want to show that to new credit providers.

13. Myth: Using Cash or a Debit Card Improves a Credit File

Busted! You might think avoiding credit is a good way to demonstrate prudence to a new credit provider. Not true. They can only see what’s in your credit file. They would rather see the prudent use of credit. Moderate borrowing allied to on-time payments made in full.

14. Myth: Increasing Your Savings Improves Your Credit Rating

Busted! Your savings are not included in your credit file. Credit providers can’t see them. They are more interested in how indebted you are and how good your repayment behaviour is. If you suddenly have extra cash and you want to improve your credit rating then it may be better to pay down some debt rather than simply saving it. However, in the UK there is a service called Loqbox that uses a savings plan to pay down a 0% interest loan. The regular payments are reported to the credit agencies with the specific purpose of improving your credit rating.

Role of Credit Reference Agencies

The UK and the USA have the same three major credit bureaus:

- UK: Equifax, Experian and TransUnion

- USA: Equifax, Experian and TransUnion

They are repositories and guardians of your credit data. Their role is not to make credit decisions. It’s FICO who is often used by lenders to develop credit scoring models.

15. Ensure Your Credit Files are Up to Date at All Major Credit Bureaus

Don’t assume that the three major credit bureaux each have the same information about you. Also, lenders may only refer to one of them when you apply. Therefore, it is in your interest to ensure that what they do have is complete and error-free.

16. Order Your Statutory Credit Report From Each Agency

Since 1974, UK consumers have had a statutory right to access a copy of their credit report. It used to cost £2 but has been free since 2018’s GDPR privacy regulations were introduced. You can make a request via the websites of the three major agencies. This is the lowest-cost way of checking your file and content. USA federal law allows you to get a free copy of your credit report every 12 months from each credit bureau. To get yours use the AnnualCreditReport.com service.

“Before I start anything to do with debt or credit I start by pulling my free credit report from AnnualCreditReport.com, the only place where you get 100% free credit reports as authorised by federal law in the USA.”

Lance Cothern, Moneymanifesto.com

17. Sign Up for a Credit Monitoring Service

Your free statutory credit report (UK) is a snapshot in time. If you want to keep tabs on how your credit file is developing you need a live monitoring service. All the agencies offer these at a price, but there’s also a way to get them for free! These give you a sense of your creditworthiness and you can see them change over time.

18. Check Your Files Annually and Before a Major Application

Errors in your credit file could adversely affect your acceptance by lenders. Even if you don’t find errors you might find evidence of applications made in your name – i.e. attempted identity fraud. It’s better to find and fix problems before you apply for credit than the other way around.

19. Myth: Checking Your Credit Report Hurts Your Score

Busted! When a credit provider looks at your credit file this search is recorded (unless it is a “soft search”). Too many searches could make lenders cautious – they might feel you’re desperate for credit. However, looking at your own file is not the same thing as a search by a third party. If anything, you are doing the responsible thing.

20. Myth: Everyone Only Has One Credit Score

Busted! Credit bureaus can provide credit scores to consumers. Each company uses difference score scales and ranges (e.g. Experian 0-999, Equifax 0-700). However, they are only indicative. The only credit scores that matter are those calculated by lenders using their bespoke credit models and your credit file data. Therefore, the thing to focus on is the contents of your credit file and the way you manage debt and money in general.

21. Myth: A Better Job and Income Means a Better Score

Busted! A higher income and a more powerful job do not make you a better credit risk. Neither of these factors is stored in your credit file and have no bearing on whether or not you will be accepted for credit.

22. Always Check Your Credit File After a Credit Rejection

If you forgot to check your file before you applied for credit and were rejected then you must check afterwards. Simply making further applications will hurt your score and trigger a downward spiral of desperation. Check your file, and fix any problems you find. Only then should you make further applications and only to appropriate lenders. You need to be targeted in your approach.

23. Credit File Error? Speak to the Credit Provider

So you’ve checked your file. You’ve found an incorrect record – perhaps a missed payment that wasn’t missed or a debt you don’t have. Working on the basis that the credit agency is simply a repository you’ll need to contact the credit provider. Raise the issue with them and provide the evidence. Get them to correct your file, but be patient as it could take time.

“Once you’ve checked your credit report if you find any inaccuracies be sure to contact your credit provider. VIGOROUSLY dispute any errors, and ask them to make the corrections. You’ll have to be patient though; after they make the changes there is typically a time lag before the changes officially show up on your credit report.”

Len Penzo, Len Penzo dot Com

24. Credit File Error? Contact the Credit Bureaus

It is possible to go direct to the various bureaus. In the USA, the Consumer Financial Protection Bureau (CFPB) recommends this. However, as they will have to talk to the credit provider this could simply cause a delay. You need to judge the correct route depending on the type of error you’ve found.

25. Credit File Error? Apply for a Notice of Correction (UK)

This allows you to add a statement of up to 200 words to an entry in your file if you are unable to get it removed. You might choose to do this if, for instance, you missed a payment due to illness or unemployment. Lenders are legally required to read these notices and this means that you should not be automatically credit scored. Contact the credit agencies to apply for a notice of correction.

26. Credit File Error? Complain to the Financial Ombudsman (UK)

Already disputed a credit file entry with the credit provider and been rebuffed? If you are adamant the entry is wrong then you can appeal to the Financial Ombudsman. They will investigate your claim and get back in touch with the lender. If the Financial Ombudsman finds in your favour, they can force the lender to remove the error from your file.

“When complaining you should describe events, bullet points are useful and make it very clear, especially when dates are involved. If the complaint is long, summarise the points (e.g. 10 phone calls, 2 visits, 2 letters, wrong information etc.). You should also use reference numbers where appropriate, make it easy for them to find your case.”

Helen Dewdney, The Complaining Cow

27. Credit File Error? Make use of the GDPR (UK)

This is a bit left field. The 2018 General Data Protection Regulations mean you have more control over the data held about you. However, to use this legislation to solve a data-related problem you will need to go to court.

28. Request the Removal from Your File of Late Payments

If you believe a late payment has been recorded by mistake then contact the credit agencies. They will ask the credit provider to check their data and correct it if it is wrong. If there is still a disagreement then the credit bureaus can help try to resolve the situation.

29. Ensure All Your Credit Accounts are Against Your Current Address

You may have unused or dormant accounts – e.g. a credit card or an old mobile phone contract. All your accounts, even those dormant ones, must be against your current address. A mismatch of addresses against your open accounts could cause you problems if you apply for additional credit.

30. If You Miss a Payment Contact Your Credit Provider Urgently

Your credit report is updated every four to six weeks with new data from credit providers. This gives you a window of opportunity to resolve a missed payment. Immediately contact your credit provider. Explain why you missed the payment (e.g. an administrative error) and settle the amount due there and then. It is likely that the situation won’t be sent to the credit reference agencies.

31. Mitigate the Damage of Any Default on Your File

You default when you should have paid a debt but didn’t. One of these is very bad news for new credit applications. If your default is fair then you could elect to settle the debt. Negotiate to get the default removed simultaneously. Otherwise, the default will be on your file for six years.

32. Act Fast to Avoid a CCJ Being Added to Your File (UK)

Missing payments may lead to a credit provider taking you to court. The court may choose to issue a county court judgement (CCJ) against you. To avoid the CCJ being logged on your file for six years you can elect to pay off the debt with 30 days of the CCJ being issued.

33. Check Your Credit Report for Signs of Fraudulent Activity

You are looking for large unexpected increases in the amount you owe or applications for credit you know you didn’t make. Act quickly if you see dubious activity on your files. Contact those credit providers who relate to the activity.

34. Don’t Let Identity Theft or Fraud Impact Your Credit Rating

If you’re a UK resident and have suffered identity theft and/or fraud you can use CIFAS “Protective Registration”. CIFAS is the UK’s “Credit Industry Fraud Avoidance Service”. Once registered your file is “flagged” which adds an extra layer of security to protect you from fraudsters. Note that being registered with CIFAS does not affect your credit rating but can slow down credit applications.

35. Check Your Data Status at CIFAS – Have You Been Registered?

You may have requested protective registration or been added to the CIFAS register by a credit provider (suspected fraudulent behaviour?). To find out your status on the CIFAS register you can make a free data subject access request. You will receive a copy of all information held about you.

36. Myth: You Can be Blacklisted for Credit

Busted! Contrary to popular belief credit reference agencies don’t compile lists of people who aren’t suitable for credit. Your ability to get credit is down to your recorded credit behaviour and whether you can afford it (see point 87 onwards). The credit bureaus simply store data as described above.

How You Manage Credit

The way you manage your various streams of credit is reported to the credit reference agencies and stored. This credit history is available for other credit providers to see.

37. Open a Bank Current/Checking Account and Use it Responsibly

Most people have a bank account. Newly opened accounts are likely to be notified to one or more of the credit agencies. Old accounts may not be visible on credit files (it depends on their terms & conditions). So bank accounts can be a very useful component for developing a good credit rating. If you can manage your account sensibly and can avoid an overdraft, then that’s very helpful. If you do need an overdraft facility then this need not be an issue, but make sure you get it pre-authorised.

38. Use No More Than 25% of Your Potential Bank Overdraft

An overdraft is a credit facility. Using one is a form of debt. You will incur interest and fees. Use an overdraft for short-term purposes or emergencies only. Overdraft behaviour is reported to credit agencies (UK) and debit bureaus (USA). From this, you can see that excessive use of your overdraft will trouble new lenders. As a rule of thumb, use no more than 25% of the borrowing limit. In the USA, it is just as important to manage your debit file well as it is your credit file.

39. Set Up a Low-Value Form of Credit

Something like a mobile phone contract or a retail store card is typically easier to be accepted for than a credit card. Information regarding your payment behaviour is shared with all the credit reference agencies. The monthly sums involved are likely to be small but paying these off in full and on time will help build and boost your credit rating.

40. Manage Your Utility Bills Properly

The utility companies report your payment behaviour to the credit bureaus. So make sure you pay these bills off in full and on time. These days you can automate payments using monthly direct debits (UK) or ACH payments [automated clearing house payments] (USA). Make sure you always have enough money in your bank account and try not to use an overdraft.

“Of course, paying your bills on time is a great way to maintain a good credit score, but only if those on-time payments are being reported to the credit rating agencies. Most landlords and utilities don’t do this. In the U.S. many utility companies don’t report your payments to credit rating agencies, so be sure to contact them and ask them to report it every time you send them a payment. You should also do this with your landlord if you are a renter. This could help your credit score increase significantly once the credit bureaus have a record of on time payments to consider.”

Dr Jason Cabler, Celebrating Financial Freedom

41. Build Your Credit Using Your Monthly Rent Payments

For decades, rental payments haven’t been reported to the credit bureaus. This seems very unfair given that mortgage payments are. This has changed. Now it is possible using the UK Government-backed CreditLadder initiative. Paying your rent on time now boosts your credit rating. This should be a great aid if you are working towards getting a mortgage.

“In the USA your rent payment is considered a type of debt that you must pay to live. As a result, your regular payment of it will be reported and considered a benefit to your credit score.”

Michael Dinich, Your Money Geek

42. Where Possible Pay Bills Using Direct Debits / ACH Payments

The use of direct debits/ACH payments helps to reduce the administrative burden of routine bills. No longer will you forget to pay your bills on time and in full. Given that missed payments and defaults are very harmful to your credit rating this one act may significantly help to protect you. Just make sure you have sufficient money in your bank account at all times to make those payments.

“Everyone should set up automatic payments if they can. With so many aspects of our lives becoming digital and on the go, it only makes sense to ease the burden of remembering when to pay a bill and doing it manually.”

Chris Muller, MoneyUnder30.com

43. Make Debt Repayments on Time and in Full

Even a couple of missed payments will cause you credit problems that will last for years. A record of missed payments will sit on your credit file for six years. Some credit providers will take into account late payments when judging your credit application. It could pull your credit score below the minimum cut off point. So, don’t miss payments.

“According to FICO, 35% of your credit score is determined by your payment history so continuously missing payments will impact your credit score. If you do miss a payment deadline or accidentally pay the wrong amount then contact the credit provider, apologise and ask for leniency so they won’t report it.”

Michelle Schroeder-Gardner, MakingSenseofCents.com

44. Missed Payments Could Become a Default

If you fail to make payments, the creditor may eventually default your debt. This means the creditor will cancel the agreement with you and probably take steps to get the debt paid. Defaults within the last 12 months are very punishing. If you are struggling to find the funds to pay off the debt, you must talk to your creditor. They may allow changes to your repayment schedule. Your credit score could be affected but it is preferable to defaulting or suffering a CCJ.

45. Stick With Old, Well-Managed Accounts

You may be tempted to swap a new credit account for an old one e.g. one credit card for another; one utility company for another. That’s fine of course if there are savings to be made but keep in mind that old, well-managed credit accounts will usually improve your score. Switching to new ones could mean your rating takes a hit for a while.

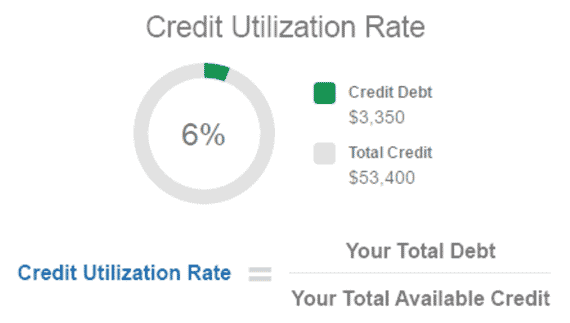

46. Keep Your Credit Utilisation Low

Credit utilisation is the percentage of your total credit limit across all your credit channels that you are using. If your total limit is £3000 and you’re using £1500 of it then your credit utilisation is 50%. Try to keep it to no more than 25%. This may influence other decisions you might make (see points 57-65 and 94).

47. Only Borrow What You Can Afford to Repay

Lenders are obliged to conduct affordability checks. But you also need to manage your spending and borrowing as necessary. Excessive amounts of borrowing and financing it at high-interest rates is a route to future missed payments and defaults. Be honest – can you afford to take on more debt? Should you?

48. Myth: Paying Off Your Student Loan Will Aid Your Credit Rating

Busted! A student loan is not a normal kind of debt and is not included in your credit file. It will not affect things like your credit score or credit utilisation rate. Therefore, if you apply for credit it only comes into play on the affordability measure – you’ll possibly be having deductions from your salary to gradually pay off your student loan.

49. Avoid CCJs, DROs, DMPs, IVAs and Bankruptcies

Missed payments and defaults are not the only things that will be on your credit file for six years. County Court Judgements (CCJs), Debt Relief Orders (DROs), Debt Management Plans (DMPs), Individual Voluntary Arrangements (IVAs) and Bankruptcies will also stay on your file six or more years. In the USA, these periods can be even longer.

50. Settle a CCJ within 30 days

Settle a County Court Judgement (a “decree” in Scotland) within 30 days and it won’t be added to your credit history. If you can’t settle it then it will be on your file for six years. It will seriously impede you getting any further credit.

51. Understand and Abide by Credit Agreement Terms & Conditions

Before you sign any agreement, including credit agreements, read and understand the terms. Seek clarification if necessary. Do not sign if you do not agree with the terms. However, once signed you must abide by them. With credit agreements, this will include strict payment terms. If you are struggling to meet the terms you must contact the other party.

52. Reduce Debt Balances

You may wish to reduce your total debt balance at a dramatic rate to improve your score. However, this isn’t necessary. Even slightly reducing the balances on a few accounts could aid your overall credit score (also see points 94-96).

53. Don’t Apply For More Credit If Already Struggling With Debt

This would be a cycle of madness. Also, credit providers would probably stop you. The right thing to do is to reduce spending on non-essentials. Use those savings to start to pay off your debt. Over time, your debt will reduce and your credit rating will improve.

54. Avoid Payday Loans

Recent use of any form of high-cost short term credit could be a sign your finances are out of balance. Even if you pay them off properly, the fact you used one in the first place is a bad sign. This form of credit is best avoided if you need your credit rating to be as squeaky clean as possible. Here some alternatives to high-cost, short term credit.

55. Avoid Using a Credit Repair Company

A credit repair company can do no more than you to improve your credit rating. However, it will charge you. If you follow the actions listed in this post you will begin to improve your rating for free. There are no magic short cuts to an improved credit rating. You simply need to understand the options and implement them one by one.

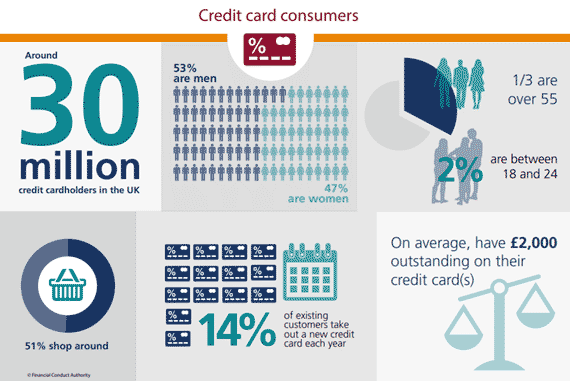

Focus on Credit Cards

Credit cards are enormously popular and enormously useful. However, they are easily misused and this can quickly damage your credit rating.

56. Take out a Credit Card to Help Build Your Credit Rating

Before you take out your first credit card you should register to vote, open a bank account and make sure you pay bills on time. Having a card provides convenience, is good for emergencies, and can help build your credit rating. Your first card is likely to be a “credit builder” card. Make sure you spend wisely and always repay in full each month.

57. Myth: It’s Good to Carry Forward a Small Balance Each Month

Busted! Bad idea! Paying interest on the balance carried forward won’t make your credit card provider give you a better rating. Credit ratings measure risk. They aren’t used as a form of reward. Besides, carrying an unnecessary balance will increase your credit utilisation that could reduce your credit score.

58. Use a “Rebuild Credit” Type Card if You Have Bad Credit

These credit rebuild cards will start with a low initial credit limit. Over time this can be increased. They typically charge a high-interest rate. The objective is always to pay off the card in full each month. This way you demonstrate good management and improve your credit rating. You get the usual cash flow benefits of having a credit card plus purchase protection (UK).

59. Avoid Credit Card Delinquency

Delinquency occurs when you fail even to pay the minimum monthly amount. Of course, you can avoid this by setting up a direct debit/ACH payment. However, if you are actively choosing to leave your credit card account delinquent be aware of the consequences. Late payments will be reported to the credit card bureaus. Interest rates will gradually rise so increasing your debt at a faster rate. At this stage, you can still choose to catch up payments. However, if you don’t the card issuer has the option of defaulting your debt and passing it to a collection agency.

60. Pay Off Your Credit Cards Twice Each Month

Making two payments each month helps to reduce your credit utilisation. It also means that the credit reference agencies never see the full amount of your monthly expenditure on the card. So your credit rating will be higher than it would otherwise be. Paying in two instalments also significantly reduces the risk of you losing control of your card.

61. Raise Your Credit Card Limit But Don’t Use It

A high credit utilisation rate means a higher risk and so a lower credit rating. If you can raise your credit limit, and not spend the extra, you can reduce your utilisation rate and lower your overall credit rating. Of course, the chances of raising your credit card limit are enhanced significantly by having previously managed the card well over an extended period.

62. Report the Loss of Your Credit Card Quickly

Losing your card won’t hurt your credit rating so long as you report its loss quickly. If you fail to do so then, in the worst case, you could become liable for any amount that is charged to it fraudulently. Once reported lost the credit card company will close the account and open a new one. They should transfer the account age and other information to the new account meaning your credit rating is unaffected.

63. Avoid Withdrawing Cash on Your Credit Card

There are a couple of problems charging cash to your credit card. First, lenders see this as a desperate measure; that your money management is out of control. Second, you will pay a penal rate of interest on what you borrow even if you repay the full balance at the end of the month. Withdrawing cash will harm your credit rating. The only exception could be on credit cards designed for this purpose for use overseas.

64. Don’t Cancel Unused Credit Cards

On the face of it cancelling unused credit cards seems sensible. However, think again. You’d be reducing your total amount of credit and raising your credit utilisation rate. Also, lenders may like to see that you can manage multiple credit streams successfully. Therefore, it could reduce your credit rating. On the other hand, having unused cards could expose you to an additional risk of fraud. If you do choose to close a credit card account it must be fully paid off.

“Closing a credit card can impact your credit utilisation by decreasing the amount of available credit. If you don’t also decrease the amount of money you owe, then your credit utilisation increases, which can have a negative impact on your credit score.”

Ryan Guina, Cash Money Life

65. Open New Credit Card Accounts

On the face of it, this could theoretically improve your credit rating. However, on balance we’d say it shouldn’t be your primary motive. It’s better to open a new account because it offers some financial incentive for switching than to do it simply for credit utilisation reasons. Too many cards will get confusing eventually.

“Earning airline miles and hotel points allows my family and me to travel the world for almost free. These travel rewards credit cards offer excellent bonuses when you sign up and earn additional rewards when using them for everyday purchases. When the annual fee comes due, I evaluate the benefits vs. cost of each card like a corporate CFO to make sure I’m getting enough value from them. Those that pass the test stay in my wallet, while those that cost more than they’re worth are cancelled or downgraded to a version with no annual fee. Then I begin my research to find the best credit card offers that will help me achieve my travel goals”

Lee Huffman, Bald Thoughts

Impact of Your Relationships

There are likely to be some occasions when through choice or necessity you co-sign a financially related agreement with a friend, partner or spouse. Being jointly responsible adds an extra degree of complexity.

66. Myth: People in Relationships Have a Joint Credit File

Busted! People always have their own credit files even if they are married. There is no such thing as a joint credit file or joint credit report. Even if two people become financially linked, they will still have single credit files at each credit reference agency. If later one of them applies for credit in their own name only the lender has the option to take into account the credit files of anyone financially linked to them.

67. Understand the Process by Which You Become Financially Linked

Where two people sign a credit agreement in joint names (e.g. a mortgage or finance for furniture, etc) they become financially linked. Joint agreements will appear on both their credit reports. If you view your credit report it will show you who your “Financial Associates” are and what agreements link you. It’s important to realise that the payment behaviour relating to those agreements will appear on both credit files too.

68. Avoid Becoming Financially Linked to Someone Until You Trust Them

It’s critical not to enter into joint financial agreements until you trust your partner completely. Your ability to get credit in your name in the future could be affected if you make the wrong decision. Also, it could have an extended impact and take years to unwind.

69. Make Sure Your Date is Financially Compatible

App dating doesn’t measure financial compatibility. Yet 50% of people say they wouldn’t date someone with a bad credit rating. Very early on in a relationship, you may need to rely on some subtle information gathering. How are they employed? Do they have much debt? What’s their attitude to debt? Do they budget when going out on a date? Do they choose expensive restaurants and clothes? Can they afford it? Do they own property?

“Plenty of folks are shyer discussing money than sex. And credit scores aren’t a perfect reflection of financial responsibility, because life (like sh**) happens. But if you’re looking for clues about their credit score, consider three things. First: are they punctual? Paying on time accounts for 35% of your score, so serial flakes and slow texters scare us. Second: do they take home uneaten food in a doggy bag? A truly frugal person may order the filet mignon, but they’ll eat the leftovers with an egg in the morning to get the most mileage out of what they’ve paid for. Third: do they tip well? If you gotta cut corners, it’s not cool to do it at somebody else’s expense. A low-level money stat can be overlooked in the presence of a high ethics stat. Go forth and roll the twenty-sided dice of love.”

Piggy & Kitty, Bitches Get Riches

70. Swap Your Credit Scores – Honesty is the Best Policy

This is probably not something to do on the first date! However, exchanging credit scores could be used to help build trust as well as providing reassurance. It would be great to know early on that the person you’re now with is likely to be a good financial match. What should you conclude if your partner refuses to give you their score?

71. Discuss Financial Goals

Even if you know your partner earns a decent income, isn’t an exuberant spender and has a good credit rating you may want to consider if you have the same financial targets. People in a relationship who have different objectives can start to drift apart. Over time, this could cause stress in the relationship. It’s best to be open about money-related issues.

72. Your Partner’s Bad Credit Score Could Affect You

If you are financially linked to your partner then you can each affect the other’s ability to get credit. If your partner has missed payments on their credit card or forgotten to pay a mobile phone bill then these will be recorded on their credit file. As you are financially linked if you apply for credit the provider can choose to take your partner’s credit file into account too. Your application could be rejected because of this even if your rating is perfectly good.

73. Break Your Financial Connections if Your Relationship Ends

Flatmates go separate ways, loving relationships end and people split up. Simply living under the same roof does not make you financially linked. However, if you are financially linked to someone and you’ve now parted company you should seriously consider requesting from the credit agencies a notice of disassociation (UK). You can only do this if you’ve settled all existing joint agreements (e.g. paid off loans). It means that if the ex-partner has lots of debt in their name or other financial issues it won’t affect your ability to get credit in the future.

Applying for Credit

You want to maximise the chance of acceptance of your credit application. Therefore, there are certain things you can do to aid in this regard.

74. Limit Your Frequency of Credit Applications

Each time you apply for credit it leaves a footprint on your credit file. Credit providers will see all these applications on your file. If you apply too frequently they will assume that you are desperate for credit. It could also suggest to them that you are overly reliant on it. The frequency of applications determines around 10% of your credit rating so be cautious. A good rule of thumb is only to apply once every three months at most.

75. Request a “Soft Search” Where Possible

So that applications don’t leave a footprint you can ask the credit provider to conduct a “soft search” or “quotation search”. Unlike the usual “credit search” your enquiry will not be visible to other lenders. This means it won’t affect your credit score – remember, it’s the lenders who do the scoring, not the credit reference agencies. However, keep in mind that not all credit providers can do “soft searches”. If yours can’t do you really want to make the application?

76. Use a Free Eligibility Calculator – Using “Soft Searches”

Various respected websites have developed online tools to allow you to check credit eligibility before you fully apply. They use the “soft search” method and give you a probability rating of being accepted. This can help you decide whether it is worth making a full application. This honest feedback may also help you decide the type of credit you might qualify for to help you focus. Simply do an online search for “eligibility calculator” to find these tools.

77. Time Your Applications Right

Older entries on your credit file have less weight than newer entries. If you’ve improved your credit behaviour then old bad news will be being diluted by recent good news. Also, some more significant entries like defaults and CCJs will eventually drop off your file altogether. Therefore, timing your applications is important. If certain entries are due to come off your file soon then you may like to wait a short while before applying. This should increase your chance of acceptance.

78. Apply Before a Significant Life Change

If you foresee an adverse income event but need extra credit then you could apply ahead of the event. If maternity leave or possible redundancy is heading your way, don’t wait. However, you should never lie on your applications. Also, you must make sure you can make the extra repayments even after your income reduces. If you can’t, you will harm your credit file.

79. Improve Your Credit Rating Before You Apply

Use the techniques above to improve your credit rating ahead of when you need to apply. For instance, you might be planning to change your car or automobile in 12 months, or know that you’ll need to remortgage in a couple of years. These may seem distant but it does take time to make credit file improvements. Planning like this though will pay dividends when you finally make the applications.

80. Don’t Be Unrealistic About the Credit You’ll Qualify For

If you either don’t know or are in denial of your credit rating it’s more likely you’ll apply to companies who’ll reject you. This is likely to harm your rating further. So, make sure you know how good or bad your rating is. Another good idea is to use an “eligibility calculator” (see point 76). This way you’ll have a better sense of which companies are more likely to accept your applications.

81. Find Out Why Your Application Was Rejected

Knowing why you’ve been rejected is one step nearer to not being rejected in the future. All credit providers are obliged to tell you why they have declined your application (also see point 22). You have additional rights if the decision was part of an automated credit approval process. If the computer said “no” you should insist that a person reviews your application. In many cases, a computer will fail to understand the particular nuances of an application. A human eye is more likely to give a fair decision and be able to read any notices of correction on your file.

82. Use a Guarantor or Co-Signer to Improve Your Chance of Acceptance

If your credit rating is less than ideal, you could get the backing of a third party whose rating is stronger. With a guarantor or co-signer in place, the lender is going to be more likely to offer you credit. Both you and the guarantor need to be clear about what happens if you fail to make the required payments.

83. Offer Some Security to Improve Your Chance of Acceptance

Being able to offer a lender an asset as security is likely to improve your chances of getting a loan if you have a bad credit rating. There are a variety of things owned by you – e.g. houses, cars, jewellery – that lenders would find acceptable. These types of secured loans are more complex to set up than a personal (unsecured) loan.

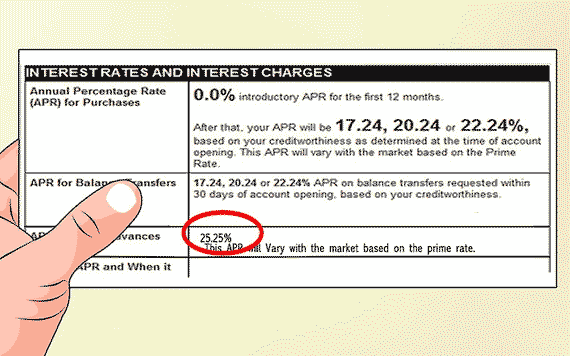

84. Pay a Higher APR% to Improve Your Chance of Acceptance

Most lenders will adjust their interest rate upwards to compensate for the extra risk. Credit providers will view people with a poorer credit rating as being higher risk. Therefore, if you know your credit rating is below average you should be looking to lenders who charge a higher APR%. These lenders are more likely to accept you. First though use an “eligibility calculator” (see point 76) to help you judge the situation more precisely. Also, request “soft searches” (see point 75) wherever you can.

85. Only Apply for Affordable Loans

You may feel you need credit at any cost. However, lenders will not only credit check you but also do an affordability assessment. They want to know if you can afford the repayments. This is a sensible precaution for both parties. If you fail to make payments it will damage your credit file. The lender will also lose out. Therefore, you should use a repayment calculator beforehand to estimate your payments and decide for yourself whether it’s worth applying.

86. Provide the Largest Mortgage Deposit / Down Payment You Can

Before the 2008/9 financial crisis, you could get a 100% mortgage (i.e. no deposit required). After the crisis, the typical deposit required soared to 20%. It is still high running at an average of 17%. However, it is certainly the case that the larger the deposit you can provide the lower the loan to value (LTV). The lower the LTV is the more reassured the lender will be and the lower the rate you will probably be able to get.

Impact of How You Manage Money

Even if your credit rating is great you still need to show any credit provider that you can afford the repayments. There is a variety of things you can do to address affordability.

87. Optimise Your Loan Affordability

You need to demonstrate to the credit provider that what you are asking to borrow you can readily repay. You need to show the lender that you have plenty of surplus income with which to make the repayments. Also, making these payments will not put you under any financial stress. The more affordable the loan looks the more likely the lender will accept your application. Also, keep in mind that it is in your financial interest to try to repay your loan as fast as you can. This will minimise the interest costs and the overall cost of your loan. But your monthly repayments must remain affordable.

88. Affordability: Your Regular Income

You will need to provide proof of your regular income, probably by offering bank statements or payslips. Your regular income can be earned income, benefit payments, child maintenance, a pension or come from investments. Make sure you take everything into account. Any cash you might receive as income is unlikely to be viewed as either regular or indeed provable.

89. Generate Extra Income

You may decide you need to grow your income to help with the loan repayments. A loan repayment calculator can help you judge this. A higher-income should raise your chance of acceptance. Ideally, you need to expand your income before you apply for credit. Perhaps you or your partner could take on additional work. Simply selling things you own to pay the debt isn’t a solution.

“It’s never been easier to make extra money on your own time and on your own terms. And even though millions of people are taking on side hustles to earn extra income, many others remain on the side hustle sidelines, paralysed by a fear of not knowing which opportunity to pursue — or viewing trying as the first step toward failure.”

Nick Loper, SideHustleNation

90. Affordability: Your Outgoings

You need the gap between your income and outgoings to be larger than the new loan repayment amount. Many of your outgoings are likely to be fixed – e.g. housing, food, energy, travel, etc. There may be some costs you can reduce relatively quickly e.g. social activities and subscriptions. There are ways to address some of the fixed costs too although this could take time.

91. Budget Properly to Control Household Expenses

You may already do this, but if you don’t it can help to bring your costs under control. Knowing where your money goes is the first step to controlling it and making sure it is spent in the best way. There are numerous online budgeting tools that can help with this task. Look at all your bills and bank statements and work out what you spend your money on each month. For more occasional costs such as holidays build in a monthly equivalent.

“As soon as you get money, decide what it needs to do by asking yourself “what does this money have to do before I get paid again?” Then you’ll know what you have to spend money on right now and what you’ll be able to pay for later. Answering this question will instantly make you feel more in control of your money.”

Kelly Ross, YouNeedABudget.com

92. Reduce Your Costs As Much As You Can

You need to aim to minimise your costs as much as you can. First, focus your cost-cutting on those less important costs – i.e. your “wants” rather than your “needs”. Once you’ve done that you can turn your attention to switching to a cheaper supermarket or energy supplier etc.

“Choosing to accumulate only the essentials often results in financial freedom. Spending less on things you don’t really need will cut your financial expenses and increase your savings.”

Joshua Becker, BecomingMinimalist.com

93. Maximise the Ratio of Your Earnings to Your Debt

High earnings and low debt is another way of demonstrating to potential lenders that you can be trusted with additional credit. It also explains why if you already have a significant level of debt it may not be prudent to take on any more.

“Your Debt to Income (DTI) ratio is a financial comparison that looks at how much debt you have to pay back in correlation to what you earn monthly. When a lender decides whether to trust you with their money they will look at your DTI calculation to decide whether you can afford to pay them back. This is a big deal especially if you are looking to get a mortgage or a big-ticket item via a loan.”

Mr CBB, Canadian Budget Binder

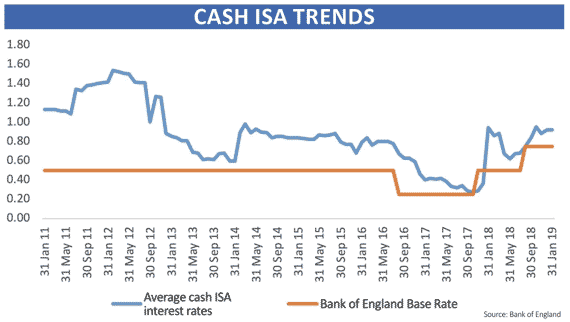

94. Reduce Your Debt With Savings

Your savings are not included in your credit report. If you have savings as well as debt you could elect to pay off some of your debt with your savings. The APR% on your debt is going to be higher than the interest rate you earn on your savings. So paying off one with the other will save you money. Generally, you should pay off first the debt with the highest APR% (more about paying off your debt in the right order). Doing this should also improve your credit rating because it reduces your credit utilisation (see above). Be careful though if your savings are sitting in a tax-free wrapper (e.g. ISAs in the UK). Before you do pay off debt with savings you might wish to get some professional advice.

95. Restructure Debt to Reduce Monthly Repayments

As part of your cost-cutting you could look at changing your debt from one form to another. The aim would be to reduce your total monthly repayments on your debt. However, keep in mind it could extend the period over which you repay the debt and in the end, the total cost could be more. You should always seek advice before doing this.

96. Pay Off Credit Card Debt

The credit card industry is very adept at trying to keep you rolling the debt on. This is how they make much of their money. You should resist and turn your attention to finding ways gradually to pay off the debt. Not adding more to your credit card debt would be step one. Then you should use cost-cutting to release funds from your monthly budget gradually to pay down the debt. You have to go well beyond paying just the minimum amount. If you stopped adding to your credit card debt now, but only paid off the minimum amount each month, it would take you around 15 years to pay it off!

“You should pay off all high-interest rate debt (especially credit cards) before investing, saving or applying for more credit. Long-term debt at a low-interest rate (like a mortgage) doesn’t need to be paid off before doing these things.”

Josh Arnold, Sure Dividend

97. Build Up Your Savings

You need to build yourself a buffer from financial shocks. If you have this buffer then, should you suffer a sudden loss of income (due to redundancy or illness), you will still be able to make your debt repayments. As you have learned, missing credit repayments is a black mark on your credit file and a default an even blacker mark.

98. Take out Payment Protection or Income Protection Insurance

Every year in the UK one million people suffer serious illness or injury that stops them working and earning. If you have savings then you may already be “protected”. Your employer may offer you sick pay. However, if you’re not protected (e.g. self-employed) you need some other way of covering your debt payments and/or your bills. Income protection insurance (permanent health insurance) replaces part of your income and is the broader (and more expensive) option. Payment protection insurance will only cover the repayments on a specific loan.

“You should buy disability insurance (income protection insurance in the UK) just before you become disabled. Since you don’t know when that time could be, earlier is generally better. However, when you are young and/or poor it can seem expensive. A good compromise is to buy a small policy when you get your first job and then continue to upgrade it each time you get a pay rise or promotion. The younger, healthier and the fewer dangerous hobbies you engage in, the cheaper your premiums will be for the same benefit.”

Jim Dahle, The White Coat Investor

99. Don’t Get Evicted From Your Tenancy

If you fail to keep up to date with your rent the landlord will eventually go to court to regain possession of their property. Your eviction will not directly affect your credit score. However, the property owner may also apply for a “money order”. If they are granted this by the court a CCJ can be issued to recover the debt. This will affect your credit rating.

100. Avoid Paying Insurance Premiums Monthly

If you choose to pay for your car or home insurance monthly, you will effectively be asking for credit. As such, the insurer will do a credit search that will be recorded on your credit file i.e. a “hard search”. You should always try to pay for insurance using one lump sum for this reason, but also because the APR% for credit can be extremely high. If you choose your insurer using a comparison website these searches are “soft searches” only. It’s not until you decide on your final insurer that you’ll incur a “hard search”.

101. Don’t Be Afraid to Get Help & Advice

There’s a huge amount to consider when managing your finances. Whether it is worrying about the present or planning further ahead. There are numerous things to consider and sometimes they seem to work against each other. Choices have to be made but you don’t have to do this on your own. You probably don’t want to discuss the bigger issues with your friends and certainly not in detail. However, there are numerous services that you can access online, in many cases access for free (e.g. Money Advice Service, Citizens Advice). Don’t delay confronting your personal finance demons. Start today and feel better tomorrow.

Conclusion

That’s quite a list!

To summarise, here are the most important things you can do to improve your credit rating and to maximise your chance of getting the loan or credit you need:

YOUR KEY ACTIONS:

- Understand what information is and is not held on your credit file

- Ensure that you’ve done everything you can to clean up your credit file

- Nurture your credit rating – have some credit and manage it well

- Use your credit card(s) with care

- Be aware of the risks of joint financial agreements

- Be prudent about the way you apply for credit

- Work to demonstrate credit affordability as well as your creditworthiness

Our Money & Credit Guides

If you’re uncertain which type of credit might suit you or you have a money problem then one of our guides may help you. We summarise each type of loan and their pros and cons and address issues regarding debt and credit ratings.