HP Car Finance

- Aiming for car ownership

- New & used cars

- Dealer & private sales

- All credit ratings

- Rates from 9.9% APR

- Rep. APR 19.9% APR

What is Hire Purchase?

Hire purchase or HP is a commonly used way to achieve outright car or vehicle ownership at the end of the contract. Except in very particular circumstances, you don’t have the option to hand the vehicle back. You should also note that HP is a form of secured loan with the vehicle being the security. But if your credit history is not perfect this could mean it is easier to get credit than through the use of PCP or contract hire.

We’ve teamed up with CarFinance 247 to find you great deals on your next HP contract. They’re the UK’s leading HP car finance broker and rated extremely highly by customers.

Quotes for HP

- CarFinance 247 rated 4.6/5

- All credit ratings covered

- You get a dedicated adviser

- Car history check & valuation included

- No Fees!

- Questions about HP? Read our FAQs

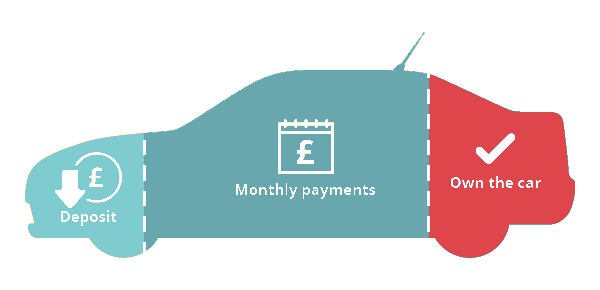

How Hire Purchase (HP) Works

- You make an initial deposit which is typically around 10% of the car’s value

- You make fixed monthly payments for the duration of the contract (usually 2 to 4 years)

- When you have made the final payment you take ownership of the vehicle

As a route to eventual ownership, HP is likely to prove cheaper than a PCP deal. Another way of looking at this is to think that with PCP you have to pay a premium for being able to delay the ownership decision until the end of the contract. And an early commitment to ownership by using HP gives you a discount.

There are some practicalities of using hire purchase that you need to be aware of:

- your monthly payments will be higher than with PCP or contract hire because you will own the vehicle at the end

- you won’t be able to sell or modify the car until you own it

- but you should not be faced with any usage/mileage restrictions (unlike PCP/contract hire)

How to Choose the Right HP Deal

Our associate CarFinance 247 is one of the UK’s leading car finance brokers. We’ve teamed up with them because they offer excellent service (a 4.6/5 rating on Trustpilot) and share our values. Their service extends beyond simply finding your HP finance. They have an approved network of dealers you can use if you wish, and regardless of where you find your next vehicle, they will check its history and value for your peace of mind. And they do not charge any fee! If you are a young driver aged 17 to 21 you may want to consider Marmalade’s car finance offer.

1: Decide what you need

Consider both the amount you need to borrow and the amount you can afford to repay each month. Learn about car finance

3: Buy with confidence

CarFinance 247 can help you find a car to meet your needs if you haven't already got one in mind. They can provide a history check and valuation for peace of mind. Learn about CarFinance 247Aged 17-21? Learn about Marmalade

4: Get on the road

Once the lender has approved your application CarFinance 247 will pay the dealer for you and all you need to do is collect the car!

OTHER TYPES OF CAR FINANCE

Car finance covers a variety of financial products that enable you to buy a car. In addition to hire purchase there are other options you may wish to consider. Click on the products you want more information about or compare them side by side.

Which type of car finance product may best suit your needs?

Car Finance Loans Guide

If you’re uncertain which type of credit might suit you or you have a money problem then one of guides may help you. We summarise each type of loan and their pros and cons, and address issues regarding debt and credit ratings.

Got a Question about HP Car Finance?

Answers to Common Questions

Please note: this information is for guidance only. You should clarify the terms of the loan with the lender before entering into an agreement.

Hire purchase (HP) is a route to buying a new car outright. In other words to become the eventual owner of the vehicle. Other forms of car finance such as contract hire or leasing simply allow you to use the car for an agreed period but you never own it.

PCP is a hybrid of HP and contract hire that delays the purchase decision until the end of the contract. While this sounds like a good compromise you will pay a premium for this flexibility. If you definitely want to eventually own the car then HP is almost certainly going to be a cheaper way to do it. Compare payments in this example.

You should note that hire purchase is a form of secured loan where the vehicle is the security so you could have it repossessed if you do not keep up the payments.

You make an initial deposit (around 10% of the value of the car) and then monthly payments over an agreed period, typically 24 to 48 months. After you have made your final payment the car becomes yours. While you are making payments (and therefore not yet the owner) you are not allowed to sell the car nor make any modifications to it, but unlike other forms of car finance there are unlikely to be any mileage restrictions imposed.

The rule of thumb is that because HP is a form of secured loan (the car is the security) that it should be easier to get than other forms of car finance such as PCP.

As with any credit though you must keep up the repayments. In the case of HP if you fail to do so you may have your car repossessed. Do not take on any credit if you cannot afford to make the repayments.

Unlike some forms of car finance HP requires a relatively small deposit – typically 10% compared to around 30% for PCP. It can be possible on occasions to find 0 deposit hire purchase deals. And of course the best way to find out what is available to get a quote.

Pros of HP car finance:

- Flexible repayment terms (typically two to four years) to help fit with your monthly budget. Keep in mind that the longer the term the more you’ll pay in interest.

- Relatively low deposit required (normally 10% of the car’s price).

- Fixed interest rates – you know exactly what you’re paying every month for the length of the contract.

- Once you’ve paid half the cost of the car, you might be able to return it and not have to make any more payments (see another FAQ)

- If your credit score is poor it may be easier to a hire purchase deal than an unsecured alternative as the car is used as security for the loan.

- It’s unlikely to come with mileage restrictions.

- You won’t need to find a large final sum to purchase the car as you would with PCP.

Cons of HP car finance:

- You don’t own the car until you’ve made your final payment. If you get into financial difficulties the finance company could repossess it.

- You can’t sell or modify the car during the finance agreement without first getting permission.

- Monthly payments are usually higher than for PCP and leasing deals.

- Your deposit and agreement length will decide your fixed monthly payments. These will be higher the smaller the deposit is and the shorter the period of the loan.

- Until you’ve paid a third of the total amount payable (including interest and fees) the lender can repossess the car without needing a court order.

- It can be an expensive option if you only want a short contract.

With HP you make the decision up-front that you want to own the vehicle. A PCP plan gives you the option to simply return the vehicle at the end of the contract, or if you decide you want to buy it then you simply make one final (balloon) payment.

Hire Purchase (HP)

- you’re hiring the car while you make payments

- you pay a deposit, make monthly payments and after you make the final payment you own the vehicle

Personal Contract Purchase (PCP)

- you lease the car for a fixed period (typically 2-3 years) and make regular payments. The size of your deposit will affect the monthly repayments you make.

- while leasing the car you don’t own the vehicle

- at the end of your lease contract you can:

- hand the vehicle back and no more costs are involved

- part exchange the car for a new PCP deal

- purchase the vehicle outright with one final “balloon payment” which you know in advance.

- Going over a set mileage will incur extra costs

- Some contracts include vehicle maintenance

UK law allows you to terminate certain types of car finance agreements early. HP agreements are one of these. Doing this is called voluntary termination and is defined in section 99 of the Consumer Credit Act 1974. This law exists to protect those whose circumstances have changed and who are no longer able to afford the monthly repayments.

You can end an HP agreement early if you have repaid at least 50% of the credit given to you (including interest and fees). With an HP contract, you’ll usually reach the 50% repayment point about halfway through the agreement (earlier than with a PCP agreement). If you haven’t repaid 50% of the total finance amount you can make up the difference, and then cancel. The car you are handing back will need to be in a good condition.